GREEN PEAK INTERNATIONAL

Your trusted partner in business.

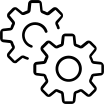

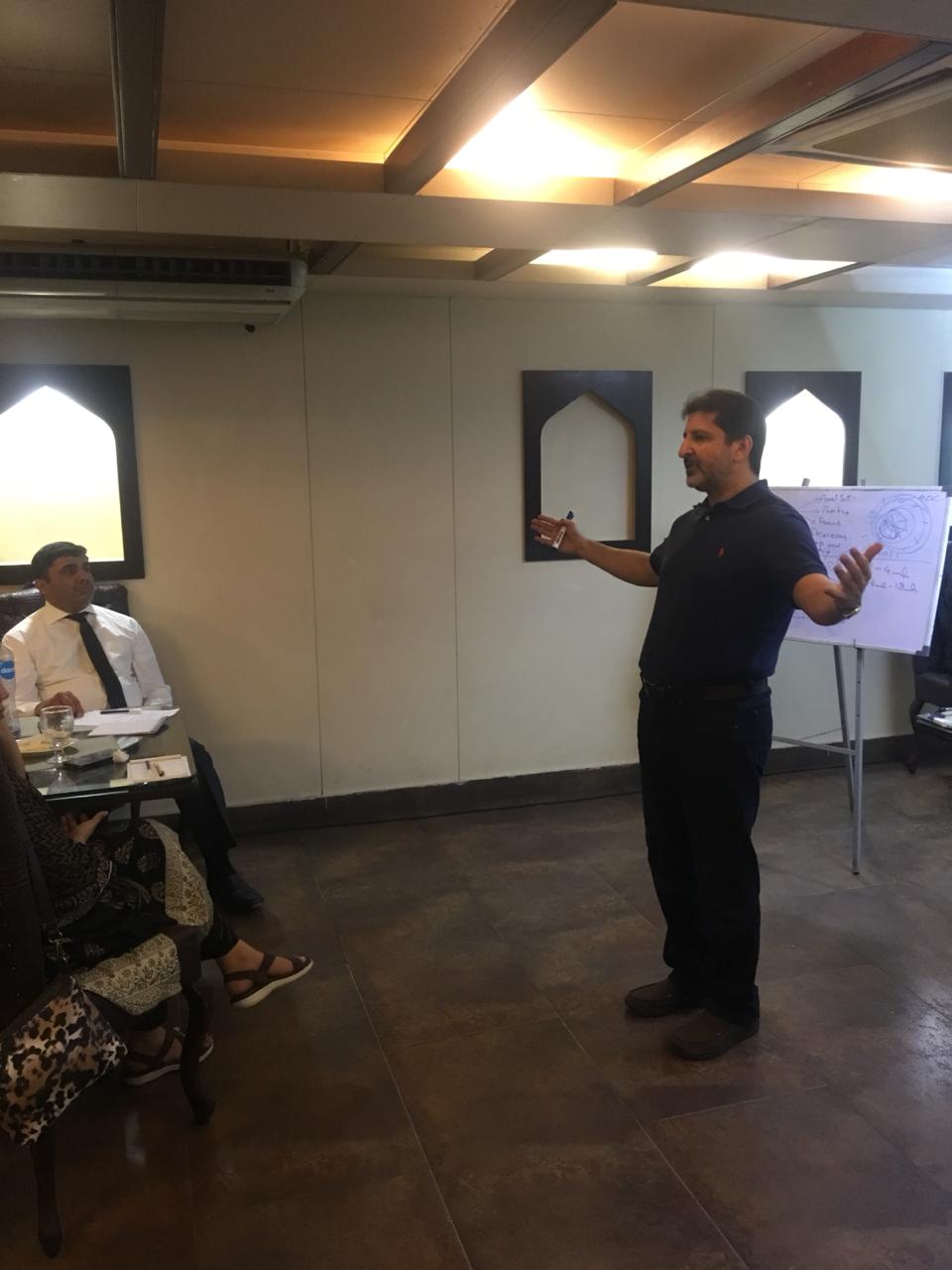

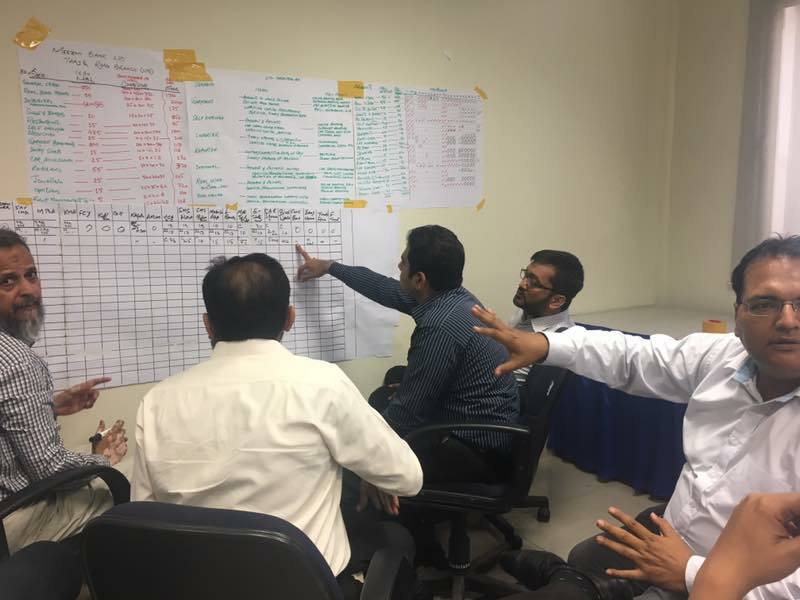

GPI offers management consultancy, training & development, and a fully integrated payroll management service.

Green Peak International is a specialized consultancy, training and development and human resource services organization committed to empowering businesses. With a wealth of experience and a passion to serve, we are your trusted partner on the road to success.